Posted 28 Jan 2010

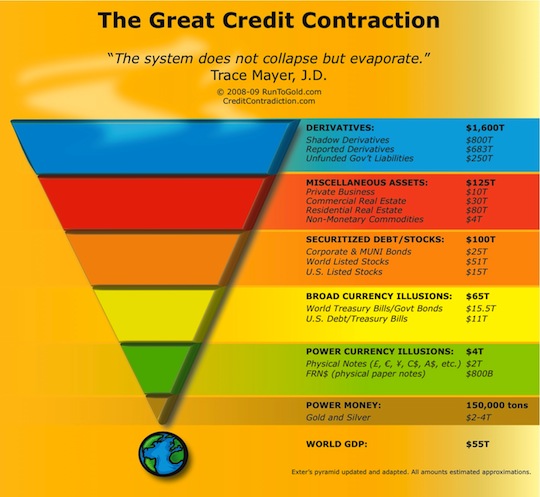

The Great Credit Contraction grinds on as the system continues evaporating. People are realizing the true nature of the worldwide fiat currency and fractional reserve banking system that is built on a fraudulent premise and has become a Ponzi scam of epic proportions, the largest in the history of the world.

Capital, both real and fictions, has begun burrowing down the liquidity pyramid while the upper layers evaporate. Recent developments in the one month United States Treasuries appear to portend another round of credit crisis.![]()

![]()

THE TREASURY BUBBLE

THE TREASURY BUBBLE

A year ago I discussed how the Treasury bubble was the largest of all and explained both how and why it would burst. I prognosticated:

However, as more capital piles into them it drives rates lower and lower. Eventually Treasury Bill rates reach 0% or even go negative. This presents a problem.

Why hold a Treasury Bill with a bank, broker, custodian bank or the Federal Reserve itself when you could take possession of physical Federal Reserve Notes?

Taking possession eliminates at least two types of risks. First, is any potential counter-party risk with whoever is holding the Treasury Bill for you. Second, ‘political risk’ which is a much larger threat. ...

As the yields on Treasury Bills approach 0% they have the return of cash but do not have the benefits of cash as they may be impregnated with counter-party risk or have decreased liquidity. In other words, Treasury Bills and cash have the same benefit profile but not the same safety and liquidity profile.

This analysis also applies to demand deposits with the bank such as checking accounts or CDs. All the downside but none of the upside.

Predictably the Treasury bubble burst. Poof!

PILING INTO ONE MONTH TREASURIES

The one month Treasury has recently traded with negative rates. This portends another round of the credit crisis which could very easily have its catalyst in either another sovereign debt downgrade of either Japan or Portugal or in Austria with banks owning a large amounts of primarily mortgage assets denominated in foreign currency in primarily Slovakia but also the Czech Republic, Hungary and Croatia.

The last few weeks shows just how close the rates are towards 0%. Of course, real interest rates are already negative. But a weak FRN$ would help meet Obama's goal to double exports which would not be helped by his proposed discretionary spending freeze.

MONEY MARKET FUNDS

One tool many investors use as a proxy for their cash are money market funds. Many view these as like-cash vehicles just like many viewed auction-rate securities as like-cash vehicles for 25 years.

On 18 September 2009 I explained that I closed my Paypal money market fund because money market funds had lost government backing. On 27 January 2010 Nasdaq.com reported:

The U.S. Securities and Exchange Commission approved by a 4-1 vote Wednesday rules designed to shore up the resiliency of money- market mutual funds, with general support from the industry, although fund representatives are uncomfortable with a few points. ...

The rules also would permit a money-market fund's board of directors to suspend redemptions if the fund is about to "break the buck" by having a net asset value fall below $1 per share. Currently the board must request an order from the SEC to suspend redemptions.

"The halting of redemptions will stem the motivation for runs. It also will eliminate the need for a failing fund to sell securities into a potentially de- stabilized market and further drive down prices," Schapiro said.

For those with too much time on their hands who want to see what the proposed rule looked like I would direct you to page 32,714 of the 8 July 2009 Federal Register under proposed rule 22(e)-3. I find the discretion of the Director of the Division of Investment Management in this instance to be particularly egregious.

Treasuries are below money market funds in the liquidity pyramid because there is more safety and liquidity. If a money market fund has redemptions suspended then that asset is not very liquid and will likely find their value evaporate.

This is precisely what happened with auction-rate securities and in some cases overnight investors went from thinking they held a like-cash instrument to finding themselves holding 40 year student loans that received no payments for several years.

WHERE IS REAL SAFETY AND LIQUIDITY

On May 20, 1999 Alan Greenspan testified before Congress, “And gold is always accepted and is the ultimate means of payment and is perceived to be an element of stability in the currency and in the ultimate value of the currency and that historically has always been the reason why governments hold gold.”

During the 1990’s Mr. Rubin had devised the gold leasing scheme with the intent being elucidated by Dr. Greenspan’s testimony in 1998, “Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.”

Because of massive governmental intervention for decades through either patent activities such as legal tender laws, the tax code, etc. or latent activities such as surreptitious leasing of gold into the market the result is a massively suppressed gold price.

The tremendous amount of evidence accumulated by the Gold Anti-Trust Action Committee ought to be examined by any serious investor or money manager. As Mr. Robert Landis, a graduate of Princeton University, Harvard Law School and member of the New York Bar, asserted years ago, “Any rational person who continues to dispute the existence of the rig after exposure to the evidence is either in denial or is complicit.”

Nevertheless it is very difficult to assess an accurate value of gold, silver or platinum in this era and for a specific time period where almost all financial professionals are infected with the financial insanity virus, the system is riddled with chronic fingers of instability and it somehow muddles along like a terrifically abused zombie.

There is already a one world currency, gold, and it poses a mortal threat to fiat currency.

CONCLUSION

As the next round of the credit crisis plays out it may be worse than the earlier iterations. All of the interventions have not addressed the root causes and are actually textbook responses for someone who would want to intentionally exacerbate the greater depression.

As Ludwig von Mises predicted decades ago in chapter 20 of Human Action, ‘The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. … But then finally the masses wake up. … A breakdown occurs. The crack-up boom appears.’

New credit creation is nearly non-existant, banks are hoarding reserves so they can win the Friday bank failure lottery and the velocity of currency has slowed to glacial speeds. Because gold and the FRN$ abut in the liquidity pyramid they tend to have an inverse correlation.

Buying gold and other tangible assets, I particularly like the extremely rare and useful platinum, is the only place to go for safety from the specter of the FRN$ evaporating through hyperinflation because of all the quantitative easing.

After all, with a gold coin in hand, or with a reputable third party like the company GoldMoney, I can remain solvent longer than the market can remain irrational. Gold is not an investment but real cash because it is 'risk-free' and an instrument for wealth preservation not wealth generation.

Far into the future and long after these money market funds are frozen, retirement accounts are nationalized to buy FRN$s that are evaporated into nothing via hyperinflation the gold or platinum coin will still have value because they are tangible assets that are not subject to counter-party risk.

What, if anything, have you done to protect yourself from these looming issues and what would you recommend to your fellow readers?

DISCLOSURE: Long physical gold, silver and platinum with no interest TLT, the problematic SLV or GLD ETFs or the platinum ETFs.