Posted 08 Sep 2009

The FRN$, the world's reserve currency, has no definition and the quantitative easing will fail. After all, what is a dollar? Because there is no definition therefore it is impossible to perform accurate, or even semi-acccurate, calculations of value using this tool.

Consequently, other key ratios ought to be used to hone in and focus on value.

While the DOW may continue its rally I highly doubt it will breach 11.5 gold ounces before it resumes its downward destiny and reaching 5-6 ounces sometime this year. Silver will likely continue its upward ascent and return to a more normal ratio with gold around 55.

A little bit more difficult to prognosticate is oil but if I were to wager it would not descend too far below 15 on the chart but the probabilities are not particularly clear either way.

In May the DOW to gold ratio was 9.32, S&P 500 to gold ratio was 0.97, gold to silver ratio was 66.4 and gold to oil ratio was 16.2. I concluded,

There appears to be (1) a strong uptrend for gold, (2) a fairly decent bear market rally for equities that is running out of upward pressure, (3) a resurgent oil, (4) insane accounting sorcery that is rending any remaining confidence from the financial statements of corporations, (5) insolvent banks being sustained only through government bailout, (6) massive job losses with (6) continued bankruptcies which (7) detonate financial weapons of mass destruction.

Around the end of July I warned of the coming market crash. At the time the DOW to gold ratio was 9.5 ounces and the S&P 500 to gold ratio was 1.05.

CURRENT RATIOS

The DOW to gold ratio is 9.49 and S&P 500 to gold ratio is 1.03.

Despite the S&P 500 rocketing up over 10% in FRN$ during the past 4 months when priced in gold, a definable currency, there is no material change. In other words, despite the proclamation of recovery and green shoots, which are really only red roots, the market has not been fooled.

The rising equities are really just a function of an evaporating fiat currency. Where does the top line come from when 40% of working age Californians are unemployed? California is just a portent for the other states.

The resurgent oil price, with the gold to oil ratio at 13.95, seems to be the most difficult to explain. Because of the slowing economic picture, empty ports, empty trucks, empty railroads and empty stores the demand for oil seems to have slowed considerably. Natural gas stockpiles may soon exceed capacity.

Why the oil price, in gold, has continued rising is probably the result of it being extremely cheap compared to historical norms. Even with the 12.5% gain in gold it still has a significant ways to go before it reaches much more normal territory.

Perhaps the market is beginning to take the Peak Oil Theory seriously? But we understand the importance between gold, oil and our stomach.

Perhaps Nate Hagen understated the magnitude of the recent IEA report when he wrote, "the initial language in this year's Executive Summary is of an urgent nature." The Independent reported, "The IEA estimates that the decline in oil production in existing fields is now running at 6.7 per cent a year compared to the 3.7 per cent decline it had estimated in 2007, which it now acknowledges to be wrong."

GOLD AND SILVER

Silver's movement seems to amplify gold's. The current gold to silver ratio is 60.2 and declining quickly.

Physical gold is on the move as both the Arabs and the Chinese are moving physical gold bullion bars out of London to the Middle East and Hong Kong.

As MarketWatch reported, "Hong Kong is pulling all its physical gold holdings from depositories in London, transferring them to a high-security depository newly built at the city's airport". The timing with the CME clearing of OTC gold derivatives is particularly interesting.

Additionally, Barrick Gold "will issue $3 billion in stock to eliminate all of its fixed-price gold hedges and a portion of its floating hedges, taking a $5.6 billion hit to third-quarter earnings, the world's top gold miner said on Tuesday."

Dr. Greenspan testified before Congress in 1998, “Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.”

Central banks carry gold in the vault and gold out on loan to the bullion banks as the same line item and in effect report cash and accounts receivables as the same thing. As Bill Murphy of GATA has observed, "They cannot get this gold back. They say they lent it; when you lend something out you expect to get it back." Is the gold cartel retreating in the face of a coming tsunami of physical demand?

PROGNOSTICATION

The DOW to gold ratio is fairly above the 200dma while the gold to oil ratio and gold to silver ratio are significantly below. A relative price is the current price divided by the X day moving average. For example, the 200 day relative price would be the current price divided by the 200dma.

In FRN$ the DOW is at a 200 day relative price of 1.14x, gold is at 1.05x, silver is at 1.26x and oil is at 1.29x. Based on seasonal trends gold and silver will be strengthening, with the strongest months in September and November, while oil just finished the usual August surge and will be weak the rest of the year with the weakest month in October.

This upleg in gold and silver will have significant strength because of the long period of consolidation just like in 2004 and 2006 which provided the foundation for the uplegs in 2005 and 2007 that took gold from $400 to $700 and $650 to $1,000, respectively. If the current upleg is similar to the previous two then the 200 day relative prices for gold and silver at the top of this upleg would be about 1.5x and 1.7x, respectively.

This puts $1,300 gold and $25 silver within range without greatly exceeding previous trading norms and would result in a gold to silver ratio of 52 which would be about average for the past few years excluding the panic of 2008 where silver went into backwardation for nine weeks.

If the DOW retreats to 6 ounces then that would be about 7,800 and a gold to oil ratio of about 12 would mean $110 barrel oil. While we could see both the USD Index and gold rise at the same time, because of their respective places in the liquidity pyramid, I think it is more probable than not that the USD Index will retreat below the 75 level.

CONCLUSION

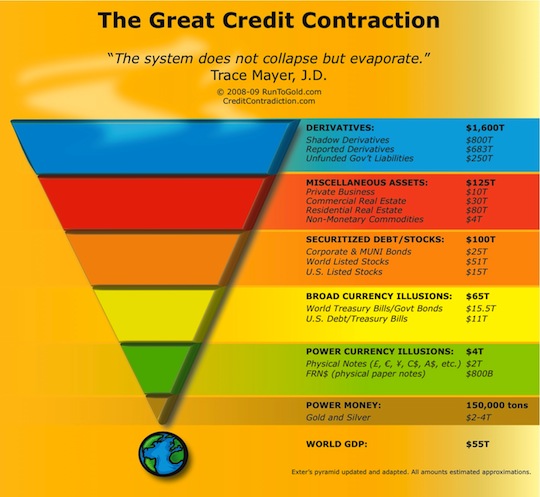

Given the shakiness of the FDIC, the routine bank failure Friday and counter-party risk from OTC derivatives, financial weapons of mass destruction, it still makes sense to establish an alternative and eventual substitute monetary system for your ordinary daily and business transactions. While the OTC derivatives were latent they have now become financially lethal.

To immunize and protect yourself and your capital I recommend either buying gold, silver or platinum and taking possession of the physical bullion or using a trusted third-party storage service like GoldMoney which allows for physical delivery at anytime. By all means, stay away from the problematic GLD or SLV ETFs if you are seeking safety.

The markets are not fooled by the red roots being touted as green shoots. The technicals, fundamentals and seasonality are merging and consequently the ratios are materially changing. The Great Credit Contraction is grinding on and capital is seeking the safest and most liquid assets. Gold and silver have been preparing for the next upleg for over a year and laid a strong foundation for a massive run which has likely just started.

Humanity’s gold lust has been dormant for nearly a century and when it awakens it will be extremely vehement and go viral. Those who own gold know of what I speak. The yellow metal seems to call out to the inner conscience and resonate with our DNA.

Our cash balances ought to be denominated in gold to avoid unnecessary risk from barbarous relics like fiat currency and fractional reserve banking.

Think of how few people have held physical gold in their hand; let alone owned it. This fact is perhaps the most bullish aspect of this upleg. Consequently, this gold party has barely started.

DISCLOSURES: Long physical gold, silver and platinum with no position in the DOW, S&P 500, Barrick or the problematic GLD or SLV ETFs.

DISCLOSURES: Long physical gold, silver and platinum with no position in the DOW, S&P 500, Barrick or the problematic GLD or SLV ETFs.