Posted 07 Nov 2008

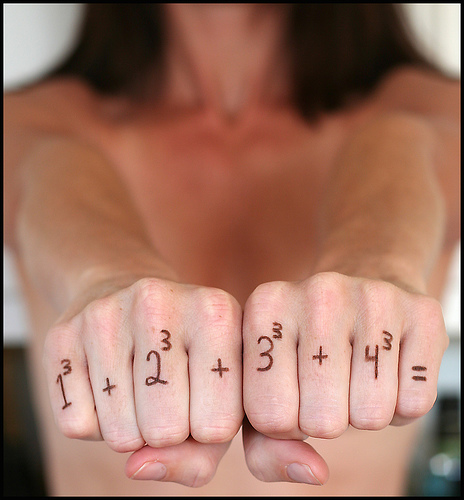

[caption id="" align="aligncenter" width="464" caption="2+2=(3)/0"] [/caption]

[/caption]

Near the end of Accounting school I remember the director of the program telling us ‘Now when an employer asks you what 2+2 is tell them it is whatever they want it to be.’

Then I went to graduate school and one of my professors told us a funny joke. ‘Do you know what the difference between medical school and law school is? In medical school you memorize all the different parts of the hand.’ After holding up his hand and moving all the fingers he said ‘In law school you ask Is that even a hand?’

The opaque world of derivatives is worse than accounting and law school combined. In this world 2+2=(3) and the answer to the question ‘What is 2?’ is unresolved.

Counter-party risk is the problem. Physical gold is not subject to counter-party risk. Gold is the ultimate form of payment and the only safe haven currency.

Derivatives have counter-parties for the 'long' or 'short' position. A failure by a party may cause the notional value of the derivative to become the real value of the derivative.

In other words, the 'long' and 'short' positions, while juxtaposed positions are not equal in value. Their respective value is dependent upon the creditworthiness of the respective party that is liable to perform.

For example, if I insure my house then I am 'long' fire insurance and the insurance company is 'short' fire insurance. As the creditworthiness of the insurance company changes what happens to value my 'long' position?

How can that value be established under current opaque accounting standards? Which 'long' position is more valuable; the counter-party being Berkshire Hathaway or AIG? What is 5 and what are fingers? Is that even a hand? How big is blue? This world makes a lot of sense.

The Oracle has been warning about the risks of derivatives for a long time. From the 2002 Annual Report:

“The valuation problem is far from academic: In recent years, some huge-scale frauds and near-frauds have been facilitated by derivatives trades. ... “Mark-to-market” then turned out to be truly “mark-to-myth.”

I can assure you that the marking errors in the derivatives business have not been symmetrical. Almost invariably, they have favored either the trader who was eyeing a multi-million dollar bonus or the CEO who wanted to report impressive “earnings” (or both). The bonuses were paid, and the CEO profited from his options. Only much later did shareholders learn that the reported earnings were a sham.

Another problem about derivatives is that they can exacerbate trouble that a corporation has run into for completely unrelated reasons. This pile-on effect occurs because many derivatives contracts require that a company suffering a credit downgrade immediately supply collateral to counterparties. ... The need to meet this demand can then throw the company into a liquidity crisis that may, in some cases, trigger still more downgrades. It all becomes a spiral that can lead to a corporate meltdown.

Derivatives also create a daisy-chain risk that is akin to the risk run by insurers or reinsurers that lay off much of their business with others. ...

In banking, the recognition of a “linkage” problem was one of the reasons for the formation of the Federal Reserve System. Before the Fed was established, the failure of weak banks would sometimes put sudden and unanticipated liquidity demands on previously-strong banks, causing them to fail in turn.

The Fed now insulates the strong from the troubles of the weak. But there is no central bank assigned to the job of preventing the dominoes toppling in insurance or derivatives. In these industries, firms that are fundamentally solid can become troubled simply because of the travails of other firms further down the chain.

When a “chain reaction” threat exists within an industry, it pays to minimize links of any kind. That’s how we conduct our reinsurance business, and it’s one reason we are exiting derivatives. Many people argue that derivatives reduce systemic problems, in that participants who can’t bear certain risks are able to transfer them to stronger hands.

These people believe that derivatives act to stabilize the economy, facilitate trade, and eliminate bumps for individual participants. And, on a micro level, what they say is often true. Indeed, at Berkshire, I sometimes engage in large-scale derivatives transactions in order to facilitate certain investment strategies.

Charlie and I believe, however, that the macro picture is dangerous and getting more so. Large amounts of risk, particularly credit risk, have become concentrated in the hands of relatively few derivatives dealers, who in addition trade extensively with one other. The troubles of one could quickly infect the others. On top of that, these dealers are owed huge amounts by non-dealer counterparties.

Some of these counterparties, as I’ve mentioned, are linked in ways that could cause them to contemporaneously run into a problem because of a single event (such as the implosion of the telecom industry or the precipitous decline in the value of merchant power projects). Linkage, when it suddenly surfaces, can trigger serious systemic problems.”

The entire worldwide monetary system is evaporating as these financial weapons of mass destruction vaporize counter-parties. It would be wise to ‘minimize links’ between you and your purchasing power.

Bullion with GoldMoney, or in your hand, is not subject to counter-party risk.