Posted 17 Sep 2012

[pullquote]For those who took my advice in December 2011 they are up about 400%.[/pullquote]The money printers are in full throttle mode with the databases whirling! Like I wrote in 2009, QE will fail but those with access to the copy-paste function for FRN$, Euros, Yen, Argentine Pesos, etc. will use it for all its worth.![]()

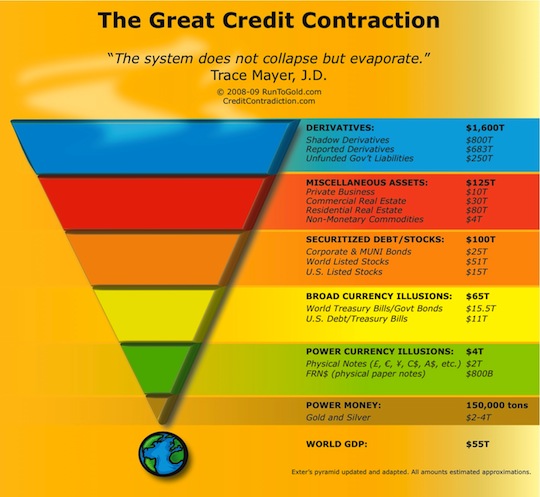

All of this is just The Great Credit Contraction playing out. Those who have properly positioned themselves are having wealth transferred to them in ever increasing amounts.

BITCOIN BREAKOUT

In December 2011 with bitcoins around $3 I wrote about a solid Bitcoin breakout with the prognostication "But I would take a bet for BitCoins to hit $7.50 by June or July at around a 50-70% probability." Once again, like with platinum, oil majors versus gold and the recent dollar downleg; I was right. Bitcoin hit about $7.00 in July and has powered higher to $12 currently.

For those who took my advice in December 2011 they are up about 400% in FRN$ terms and about 350% in gold terms. The market is telling the gold bugs their purchasing power is moving to bitcoin holders. Wealth transfer at work, baby!

[pullquote]Bitcoin is actually pretty simple; it is just math. But then math can seem like mystery magic to some.[/pullquote]BITCOIN INTERVIEW WTIH FUTUREMONEYTRENDS

Mr. Casey has a keen economic and financial mind and always seems to have something entertaining to say so I wandered over to the recent Casey conference and ran into the guys from Future Money Trends.

We did an interview on Bitcoin which, to toot my own horn, I think turned out pretty well. Our interviewer showed one of the most important traits an investor can have: skeptical humility.

The irony is not lost though that Doug Casey, like David Kramer, gave an opinion last year on Bitcoin which betrayed a complete lack of technical understanding. It seems there are clear divisions within the sound money niche on Bitcoin.

For some Bitcoin may seem complex. Let me assure you that just like with email or Internet browsing you do not need to understand how this magic Internet money, the Bitcoin Protocol, works at its core to derive value from using it just like you do not need to understand how Internet Message Access Protocol or Hyper Text Transfer Protocol works. You know, iPhones, text messages and movies are magic also. Bitcoin is actually pretty simple; it is just math. But then math can seem like mystery magic to some.

But if you do not comprehend or understand an XOR cipher function, Elliptic Curve Digital Signature Algorithm and some basics of Classless Inter-Domain Routing then it may be best to sit down, shut-up, listen to some people who do understand, ask what questions you can formulate based on your limited understanding, do some study and then try to form an opinion based on facts instead of facile intelligence where one thinks they have a talent for monetary science, economics and finance but do not see the need to undertake the hard labor of learning how such arguments are constructed when applied to the Bitcoin Protocol.

After all, do you want to be the guy that asks, "How big is yellow?" or worse ignorantly pronounce the statement, "Yellow is really big."

[leadplayer_vid id="5056EDD42ED07"]

BITCOIN PRICING POTENTIAL

To be honest, I am having a very difficult time attempting to value bitcoins and prognosticate a price. Plus, there could be some type of attack on the network or other issue that could make all the purchasing power of bitcoins completely evaporate.

Nevertheless, there are number of wallet users, connected nodes, merchants that accept it, number of transactions, etc. By some estimates the Bitcoin economy GDP is about 10% the size of Uruguay or about 1% the size of Argentina.

As Mr. Shrem recently told Federal Reserve and Brazil central bank officials, "BitInstant was processing 1/5th of the monthly payments of Chile’s internal payment system. I was thinking, Bitcoin might become a real currency before anybody even realizes it. Mark my words, sometime in 2013, the Bitcoin economy will be larger than that of a few small nations."

But you are dealing with a community of secret keepers so getting accurate numbers is difficult if not impossible. Some people have tried to distill various metrics down and have come up with a current growth rate around .46% per day with a growth decay of .024% per day. This is what a log 10 scale chart looks like extrapolating based on actual metrics.

DISINTER-MEDIATE FROM THE FINANCIAL AND MONETARY SYSTEM

MF Global misappropriated customer segregated funds and the regulators have just twiddled their thumbs. Then PFG Best did the same thing and regulators have just continued twiddling their thumbs.

Can anything be more ergerious than deeply captured regulators idly, or perhaps complicitly, allowing such nefarious behavior? How can you trust the traditional banking, financial and monetary system?

But, in a way, you have to trust it. Until now you have had no alternative or substitute. You have had to bear counter-party and performance risks. As The Great Credit Contraction continues its relentless grind these risks become ever more pertinent.

[leadplayer_vid id="5056EE11452E3"]

[leadplayer_vid id="5056F379C7137"]

CONCLUSION

The Great Credit Contraction is in full force. Those who have moved into safe and liquid assets are having wealth transferred to them at an ever increasing rate. While I continue to be a big proponent of gold and silver I have also becoming increasingly trusting of the Bitcoin Protocol where one's bitcoins just sit there secured by the laws of mathematics and cryptography backed by petaflops of processing power and verifiable so long as you have Internet access.

The liquidity of bitcoins is ever increasing with a debit card due in a few months. With only exchange rate risk, bitcoins make a great addition to one's portfolio in The Great Credit Contraction, which if you have not read you can buy with bitcoins. Go ahead, get some bitcoins and give it a try. What do you have to lose, really?

I told you my thoughts. By all means, please leave your thoughts in a comment. Thanks!